Insurance policies policies are a crucial portion of contemporary existence, providing defense and assurance within an unpredictable globe. Regardless of whether it's for your property, auto, health, or existence, insurance plan procedures can provide fiscal stability in the event of an unanticipated occasion. But what precisely are insurance policies, and why do we need them? This article will explore numerous components of insurance policies, breaking down their types, Gains, and worth in a means that's quick to be familiar with. When you are new to insurance policies or simply just trying to find a refresher, this guidebook will assist you to navigate the planet of insurance policy guidelines with assurance.

At its Main, an insurance policy coverage can be a agreement between you and an insurance company. The insurance provider agrees to offer financial coverage for particular threats in Trade for regular payments referred to as rates. Put simply, you shell out a set sum of money on the insurance provider, they usually promise that can help cover the fee if something goes Erroneous. Think about it like spending a little cost to avoid a Significantly larger economical stress Later on.

More About Insurance Solutions

One of the more common forms of insurance policy insurance policies is vehicle insurance policy. Auto insurance policy helps protect The prices connected to mishaps, theft, or damage to your auto. In some instances, it might also deliver legal responsibility protection, guarding you for anyone who is at fault in an accident that damages somebody else's property or will cause injuries. With no automobile insurance coverage, a straightforward fender-bender could grow to be a money nightmare, leaving you with expensive fix expenses and professional medical costs.

One of the more common forms of insurance policy insurance policies is vehicle insurance policy. Auto insurance policy helps protect The prices connected to mishaps, theft, or damage to your auto. In some instances, it might also deliver legal responsibility protection, guarding you for anyone who is at fault in an accident that damages somebody else's property or will cause injuries. With no automobile insurance coverage, a straightforward fender-bender could grow to be a money nightmare, leaving you with expensive fix expenses and professional medical costs.Homeowners insurance is yet another essential coverage for homeowners. This sort of insurance plan shields your home and private possessions in opposition to damages due to things like hearth, storms, or theft. If some thing transpires to your property, homeowners coverage can assist buy repairs or replacements. Additionally, it typically handles legal responsibility, so if an individual is injured on your own property, you won't be left footing the professional medical costs. With no this type of insurance coverage, you can face financial spoil just after an unfortunate celebration.

Health coverage insurance policies are perhaps the most critical type of insurance policies for people and family members. Clinical charges can speedily increase up, and with no well being insurance plan, Lots of people might be struggling to manage important treatment plans. Health and fitness insurance policy helps cover the cost of health care provider visits, hospital stays, prescription remedies, and preventive treatment. It could also supply economic security towards unforeseen health care emergencies, like incidents or major ailments, which could otherwise drain your financial savings or place you in personal debt.

Everyday living insurance is an additional essential policy, specially for people with dependents. Lifetime insurance plan makes sure that your loved ones are monetarily supported from the party of your respective Demise. The plan pays out a lump sum to your beneficiaries, which could assist address funeral prices, pay off debts, or provide profits alternative. While it will not be essentially the most pleasant topic to consider, having daily life insurance policies can offer you relief knowing that Your loved ones will probably be looked after, even if you're not all over.

For many who individual a company, business enterprise insurance policies insurance policies are important. These insurance policies protect from financial losses connected with such things as residence hurt, worker injuries, or lawsuits. Depending on the type of small business, diverse insurance policy policies can be required. For instance, a small enterprise operator may well want standard legal responsibility insurance, when a business in the Health care sector could have to have specialized protection like malpractice insurance plan. It doesn't matter the business, possessing the proper small business insurance policy makes certain that you happen to be lined in the event of surprising gatherings.

Whilst coverage insurance policies are intended to secure us, they can also be confusing. There are several differing kinds of coverage, Each and every with its have procedures and boundaries. Some insurance policies are necessary, like auto insurance policies, while others, like life insurance policy, are optional but very encouraged. Being familiar with the terms and conditions within your plan is critical to ensuring that you're adequately View details protected. Often go through the great print before signing any insurance policy contract to avoid surprises in the future.

Rates really are a essential ingredient of any insurance plan coverage. Rates are the amount you shell out to take care of your insurance policy protection. They could vary extensively determined by aspects like your age, health, the sort of protection you require, along with your statements background. Such as, young drivers typically shell out increased premiums for automobile insurance policies due to their lack of practical experience at the rear of the wheel. Likewise, anyone which has a history of health-related situations might confront bigger rates for health and fitness insurance. Browsing all-around and evaluating offers from distinctive insurers will help you find the best deal.

Along with rates, insurance policies procedures frequently come with deductibles. A deductible is the quantity it's essential to pay back outside of pocket ahead of the insurer commences covering expenditures. As an example, if your automobile insurance policies provides a $500 deductible, You will need to pay for the main $500 of any maintenance prices your self. Deductibles are usually higher for guidelines with reduced rates, so it is vital to find a balance that actually works for the spending budget. The lower the quality, the upper the deductible, and vice versa.

Statements are A vital part of the insurance coverage approach. When a little something goes Erroneous, you file a claim with all your insurance company to ask for payment for the reduction or damage. The insurance provider will then assess the problem and decide whether the claim is legitimate. If your assert is authorized, the insurance provider will pay out a portion of The prices, minus any deductible. It's important to keep comprehensive information and documentation, such as receipts or pictures, to assistance your assert and be certain a clean method.

Insurance policy insurance policies frequently have exclusions, which can be cases or situations that aren't included via the plan. One example is, numerous motor vehicle insurance coverage insurance policies Really don't protect injury caused by purely natural disasters like floods or earthquakes. Likewise, overall health insurance policies may well not protect certain elective processes or treatment options. It is necessary to be familiar with the exclusions in the coverage so You do not believe you might be lined when you are not. When you are Not sure, talk to an insurance plan agent or broker who can clarify any ambiguities.

One thing to bear in mind when looking for coverage is the fact that The most affordable selection is not the best. When It is really tempting to choose a minimal-Charge coverage, See all details it's important to consider the coverage it offers. In some cases, a reduced quality could possibly mean significantly less complete protection, leaving you exposed to fiscal dangers. On the flip side, a more expensive policy might deliver much more in depth security and satisfaction. Usually weigh the advantages and disadvantages of various guidelines prior to making a choice.

Insurance Portfolio for Dummies

When contemplating an coverage policy, It is also significant to consider your lengthy-phrase wants. As an example, in case you are buying lifetime insurance, you'll want to decide on a plan which will present suitable protection all through your life. In the same way, when you are purchasing overall health coverage, be certain the strategy will deal with any potential professional medical requires as you age. Coverage needs can transform over time, so It can be a good idea to overview your insurance policies routinely and make adjustments as wanted.As well as classic insurance plan insurance policies, In addition there are specialised sorts of coverage for area of interest predicaments. For example, travel insurance plan can guard you if some thing goes Incorrect for the duration of your excursion, such as a flight cancellation or misplaced baggage. Pet insurance coverage is an additional popular solution, assisting pet entrepreneurs deal with the expense of veterinary bills. These specialized policies provide satisfaction for certain elements of lifestyle, guaranteeing you happen to be protected it doesn't matter what transpires.

Knowledge See it here the role of the insurance plan agent or broker could also aid simplify the whole process of choosing the ideal plan. An insurance policy agent signifies a person insurance company and may provide steerage around the policies they offer. A broker, However, operates with several insurance coverage businesses and may help you Review choices from various vendors. Equally agents and brokers can help you in finding the correct coverage for your preferences, regardless of whether you're looking for vehicle, property, overall health, or everyday living coverage.

Another important aspect to consider When picking an coverage plan is the insurance company's reputation. Not all insurance coverage providers are developed equivalent, plus some are noted for supplying improved customer care or more quickly promises processing than Other individuals. Before committing into a plan, make an effort to investigate the insurance company's reputation. Examine client evaluations, ratings from unbiased agencies, and any grievances submitted with regulatory bodies. A highly regarded insurer offers you self-confidence that you're in superior hands.

As you navigate the planet of insurance policy, it is important to remember that coverage is ultimately about guarding oneself as well as your loved ones. When it may appear like an avoidable expense occasionally, obtaining the ideal insurance plan policy can avoid a economical catastrophe inside the event of a mishap, disease, or catastrophe. The comfort that comes along with recognizing you are included is priceless. So, take the time to understand your options, Look at procedures, and pick the coverage that most accurately fits your requirements. After all, insurance policies is definitely an expenditure in the upcoming stability.

What Does Insured Solutions Mean?

In conclusion, insurance policy guidelines are An important element of contemporary life, furnishing economical defense in opposition to the uncertainties that appear our way. From vehicle coverage to lifestyle insurance policies, and all the things in between, Just about every coverage performs a crucial job in safeguarding our nicely-currently being. No matter whether you are a homeowner, a company owner, or simply just a person looking to safeguard your family, getting the appropriate coverage coverage could make all the real difference. So, Never wait for disaster to strike – you should definitely're protected currently!

Emilio Estevez Then & Now!

Emilio Estevez Then & Now! Michelle Trachtenberg Then & Now!

Michelle Trachtenberg Then & Now! Pauley Perrette Then & Now!

Pauley Perrette Then & Now! Heather Locklear Then & Now!

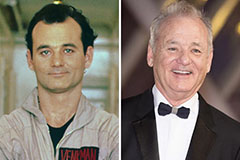

Heather Locklear Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now!